ADSS was established in 2010 in the United Arab Emirates, which is where they are headquartered today. They cater to global traders and offer their services and solutions in both English and Arabic, and they are entrusted by thousands of clients. ADSS is licensed and authorized by the SCA (Securities and Commodities Authority), which is the financial regulator in the UAE, and they offer spot forex and CFDs on currencies, equities, commodities, indices, and more with a varied level of leverage.

This review of ADSS will cover:

- Perks for UAE traders

- ADSS’s product offering

- ADSS’s account tiers

- ADSS’s trading platforms

- ADSS’s partnerships

Perks for UAE traders

ADSS is a partner of the Central Bank of the UAE, which gives them exclusive access to certain features, such as local traders being able to fund their accounts with UAEPGS, which is a fast and secure payment transfer system. Local traders who create their account with ADSS can also verify their identity and submit their documents electronically via UAE Pass.

ADSS’s product offering

ADSS is licensed to execute trades across a variety of financial instruments, including spot forex and CFDs on equities, indices, commodities, cryptocurrencies, and currencies. No commissions are charged for forex spot or CFD trades for retail traders.

- Commodity CFDs provide exposure to metals, energy products, and agricultural goods. Leverage of up to 200:1 is available when trading commodities, which can be done per individual price tick.

- Over 60 currency pairs are tradable, incorporating major, minor and exotic currencies. In addition to forex spot trading, traders can speculate on FX movements through CFDs with 500:1 leverage.

- Stock CFDs allow participants to bet on the share prices of global and GCC equities such as Netflix, Gulf Insurance, and Al-Rajhi Bank. Leverage is capped at 20:1 for these instruments.

- Index CFDs facilitate speculation on well-known benchmarks including the US100, S&P 500, the Nikkei 225, the DAX, and the Hang Seng Index. Leverage of 333:1 is available for index CFD trading.

- The broker also provides cryptocurrency CFDs, including speculation on the price movements ofBitcoin and Ethereum. Cryptos can be traded with 4:1 leverage, but they can only be traded on the ADSS proprietary solution and not on MT4.

ADSS’s account tiers

ADSS offers both demo and live accounts.

The ADSS demo account

ADSS offers clients the ability to demo trade using virtual funds before switching to a Live account. The demo account contains a balance of $50,000 US that can be reset at any time. Paper trading is available to allow backtesting of strategies.

Signing up for the demo account does not require credit card information. This gives traders access to ADSS’ full product range with real-time pricing and competitive spreads. Educational materials are also accessible to demo traders. Transitioning to a funded Live account is straightforward once ready or when the demo expires, which it does in 90 days from account activation.

The ADSS live account

Live accounts are split into three tiers – Classic, Elite, and Pro.

The Classic has a minimum deposit of $100 US and provides access to educational content, leverage up to 500:1, and trade execution with no commissions. The Elite account requires $100,000 US and builds on the Classic features with tighter spreads, private events, and a dedicated manager. For those with $100,000 US or more to trade, the Pro lowers spreads further while also including a personal sales trader.

Regardless of tier, traders can access ADSS’ platform or MetaTrader 4 for technical analysis and order placement. UAE citizens can complete streamlined verification using UAEPass and fund their account with UAEPGS. Account funding for those abroad and trading internationally is supported by Apple Pay, Samsung Pay, Skrill, and Neteller.

ADSS’s trading platforms

ADSS offers two trading platforms – their proprietary solution the ADSS platform and industry-favorite MT4. Traders with demo and live accounts can test out their trading strategies with either platform, though there is a limited timeframe (90 days) in which demo accounts are valid. After the period, traders will need to move to a live account or terminate their demo trading experience.

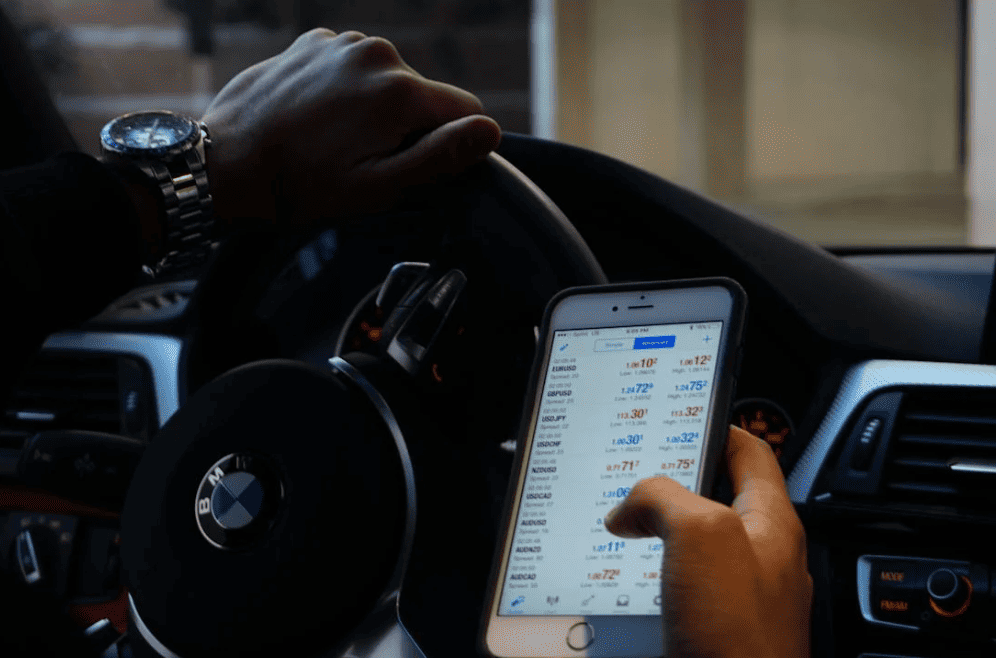

ADSS offers both platforms on desktop, in browser, and on mobile. They have their own app for their trading platform, and the transition between desktop and mobile – so far from my own experience – has been smooth. Execution is fast, and the layout is exceptionally clean on both platforms, without compromising functionality.

In my opinion, the platform chosen by the trader depends on what they wish to get out of their trading. If they have been trading for a long time and wish to have a more advanced and sophisticated set of tools for trading, they may want to stick to MT4. (Though as mentioned, the MT4 platform does not offer crypto CFD trading – only the ADSS platform does. This is worth noting.)

For newer traders, they may want to opt for the effective ADSS platform which offers clear navigation with an excellent set of charting tools and views without being overly complicated. Modules include historical and present orders, and there is an easy way for traders to keep an eye on their positions and market updates simultaneously.

ADSS’s partnerships

Beyond simply trading, ADSS provides partnerships for those motivated to further expand their involvement. Applicants must hold an existing funded Live account.

The referral program rewards introducing new clients to the brokerage. Existing traders can earn up to $5,000 through rebates by recommending friends and family who then open and trade on a live account themselves. Specific terms apply.

The Introducing Broker program is suited for those wanting to accumulate their own client portfolio in a more substantive way than referrals alone allow. Both individuals and corporations are welcomed to grow their reach. IBs profit from real-time rebates and payouts through a customizable rebate structure set by the IB themselves.

The fund manager program supplies the necessary technology and infrastructure for those aiming to oversee funds on behalf of clients but lacking their own. ADSS’ Multi Account Manager software supports functions like reviewing investor performance, generating reports, and receiving trading fees.

Finally, the affiliate program supports traders with an active financial or markets-focused website or community. By contacting the broker directly, affiliates can monetize traffic through specialized means. Partnerships thus exist for various levels of involvement beyond personal trading within the ADSS ecosystem.

Final words

Given its headquarters in the GCC, ADSS stands out as a pioneering force within both its field and regional market. Traders are offered a comprehensive suite of trading instruments across diverse asset classes. ADSS’ proprietary platform providesan intuitive trading experience. The broker maintains a low barrier to entry through its Classic live account requiring a minimum deposit of only $100 US.

Beyond personal trading, ADSS equips participants with opportunities to further develop their businesses or take on new challenges through partnership programs. The referral, introducing broker, fund management, and affiliate offerings allow expanded involvement and profit potential for the motivated.

For those located within the GCC seeking a brokerage relationship, ADSS receives a high recommendation. As one of few domiciled in the region, it combines cutting-edge features with accessibility and growth avenues and remains a stellar choice for both first-time and experienced traders alike. ADSS’ local roots paired with global expertise cement its prestigious pioneering position servicing the burgeoning GCC markets.